Ethereum Treasury ETHZilla sells 24,291 ETH to repay debt: moving from DAT to RWA tokenization

Ethereum treasury company ETHZilla announced that it has sold 24,291 ETH for early redemption of senior secured convertible notes, earning approximately US$74.5 million. This move not only signals that the company is actively clearing debt, but also officially declares that future value will be dominated by the revenue and cash flow of the RWA tokenized business.

(Preliminary summary: If MSCI blocks "more than half of the DAT market value companies", will it trigger a sell-off of more than 10 billion US dollars?)

(Background supplement: ETHZilla sold US$40 million in Ethereum to buy back shares, will it trigger a chain effect of the DAT sell-off?)

Contents of this article

US stock listed company ETHZilla Corporation (Nasdaq: ETHZ), a company that holds Ethereum (ETH) as its main treasury asset, issued an official announcement through the X platform on December 22, 2025, stating that it had sold 24,291 ETH and obtained approximately US$74.5 million in funds. ETHZilla said the move was to fund early redemptions of outstanding senior secured convertible notes.

As part of redeeming our outstanding senior secured convertible notes, ETHZilla sold 24,291 ETH for approximately $74.5 million. We plan to use all, or a significant portion, of the proceeds to fund the redemption. The dashboard below excludes cash on the balance sheet which… pic.twitter.com/c5HMDrf48X

— ETHZilla (@ETHZilla_ETHZ) December 22, 2025

Shifting to RWA business

In the announcement, ETHZilla detailed that all or most of the funds will be used for note redemption, which is expected to be held on December 24 and 20 respectively. Settlement completed on December 30th. The announcement also pointed out that the data displayed on the relevant dashboard did not include cash on the balance sheet, which will be used exclusively for this early redemption.

ETHZilla further stated that the company’s future value will be mainly driven by the revenue and cash flow growth of the real asset (RWA) tokenization business. As a result, the company has decided to discontinue the mNAV (Market Net Asset Value) dashboard on its website as of the date of the announcement. But despite this, the company promises to continue to regularly update its balance sheet and report any significant changes in ETH treasury holdings or number of shares through U.S. Securities and Exchange Commission (SEC) filings and social media.

This action is seen as a key step for ETHZilla to optimize its capital structure, clear debt and accelerate its transformation into RWA tokenized business. The company previously announced plans in early December to early redeem approximately $516 million in convertible notes due 2028.

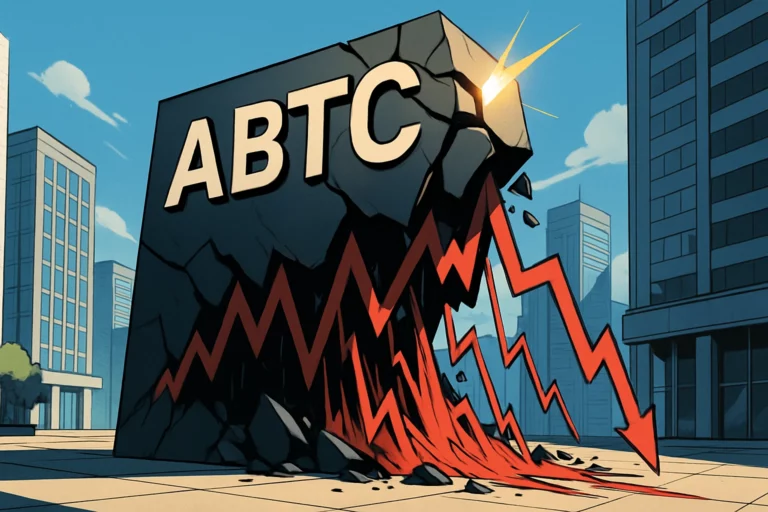

ETHZilla’s stock price plummeted 63% this year

According to Google Finance data, when ETHZilla announced the establishment of an Ethereum reserve this year, its stock price once soared. However, as the market enthusiasm subsided and Ethereum fell, its stock price has now reached the low point of the year. It has plummeted 63% so far this year, and its market value has shrunk to US$116 million.

Market concerns emerge

Although ETHZilla The move is part of an established debt management and business transformation plan, but there are still concerns in the market. The sale of 24,291 ETH was interpreted by some investors as a reflection of the difficulties faced by Digital Asset Treasury companies (DAT companies) during the current downturn in the cryptocurrency market.

As ETHZilla sells ETH, the market begins to worry about two major potential risks: First, investors are concerned about whether ETHZilla will further reduce its holdings in the future, or even clear out all remaining ETH treasury to cope with stock price pressure or capital needs; second, if such behavior spreads among other DAT companies, it may bring huge selling pressure, have a greater impact on the overall encryption market, and even trigger a chain effect, exacerbating price fluctuations and declining investor confidence.