Taiwan’s central bank says no to Bitcoin reserves again! Reply to Legislator’s “Research Report” Refusing to Follow Up on the U.S. and Czech Experiments

Taiwan’s central bank submitted a legislative report, explicitly excluding Bitcoin from entering the US$600 billion foreign exchange reserve, emphasizing volatility, liquidity and operational risks.

(Preliminary summary: Trump officially nominated Paul Atkins as the new chairman of the SEC. What is his stance on cryptocurrency?)

(Background supplement: Wall Street boycotts DAT? MSCI considers micro-strategy and other "crypto reserve companies" to be excluded from index components)

The Central Bank of Taiwan recently responded to a report submitted to legislator Ge Rujun, answering "whether Bitcoin is suitable for inclusion in foreign exchange reserves" in nearly 10,000 words.

The conclusion is unambiguous: high volatility, low liquidity and operational risk make Bitcoin unable to shoulder the responsibility of $600 billion in reserves.

When faced with the United States classifying confiscated Bitcoin as a strategic asset and Prague trying a million-dollar reserve sandbox, Taiwan’s central bank chose to stand still and maintain a line of isolation from the crypto reserve craze.

Ge Rujun provides a link to the central bank report” Click here

Global crypto polarization, Taiwan stands firm as a “conservative”

This report first names the United States and the Czech Republic. The Trump administration has established a “strategic Bitcoin reserve”, and the Czech central bank has publicly established a test investment portfolio.

However, a survey by the Official Monetary and Financial Institutions Forum (OMFIF) showed that as many as 93% of national central banks are unwilling to hold digital assets. Taiwan chooses to stand on the same side as most of the world's central banks. The reason is not only about risks, but also about its position in the global dollar system.

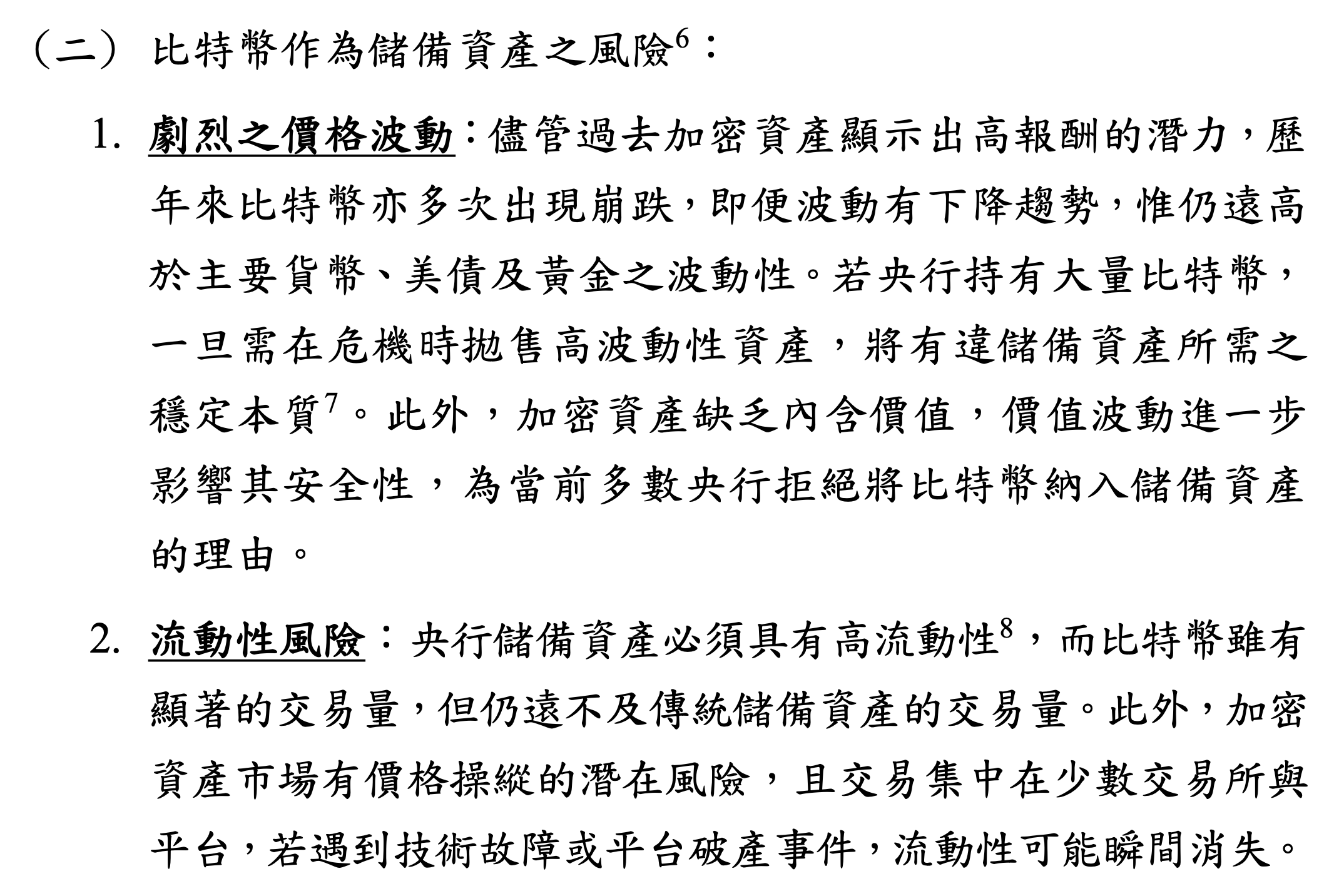

The report cited internal backtesting in the Czech Republic and pointed out that if 5% of funds were allocated to Bitcoin in the past 10 years, although the total return would have doubled, the portfolio volatility would also have doubled. The central bank believes that "the primary function of foreign exchange reserves is to be available in times of crisis."

Once it is necessary to sell off highly volatile assets in times of crisis, it will have the stable nature required for reserve assets.

The report mentioned liquidity again. Although the market value of Bitcoin exceeds trillions, if Taiwan sells off tens of billions of dollars in chips at once, the market depth is still insufficient, and on a few exchanges during the trading season, if they encounter technical failures or platform bankruptcy, liquidity may disappear instantly.

As for the operation, private keys are lost, hacked A hacker invasion may cause the country's assets to evaporate instantly. This risk cannot be tolerated in the layer-by-layer approval bureaucracy. For export-oriented Taiwan, as long as the US dollar clearing channel is open, there is no urgent need to decouple sanctions through decentralized assets.

The next round: stable currency rather than Bitcoin

Although it rejects Bitcoin, the report leaves a foreshadowing at the end: with the US dollar stable currency. The bill clarifies the regulatory framework. The central bank believes that blockchain can provide efficiency in cross-border payments and settlements, and this is the focus of the next stage of policy discussion. In other words, Taiwan may give priority to loosening stablecoins as payment tools. As for Bitcoin, it will still be placed outside the watch list.

For Taiwan’s central bank, foreign exchange reserves are a shield, not a bargaining chip; Bitcoin may have already been endorsed by some U.S. officials, but before knocking on the door of Taipei’s vaults, the “old rules” of the three reserves of volatility, liquidity and operability must first be answered.