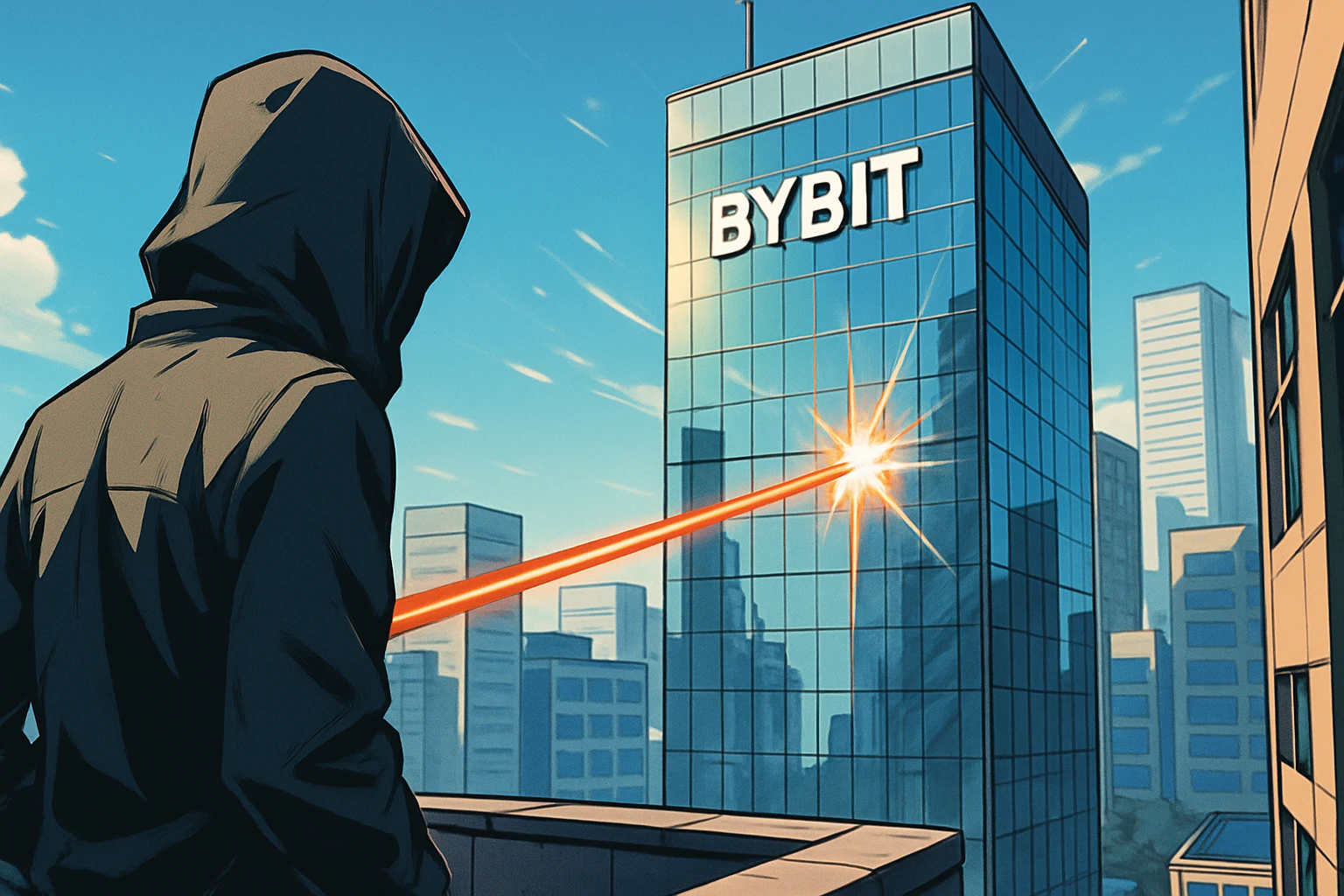

Software company CFO misappropriated $35 million of customer funds to gamble on DeFi and lost it all

Theresa Spino, the former CFO of Moxie Software, an American software company, misappropriated US$35 million and invested in DeFi and lost all her money, highlighting that when financial authority is excessively concentrated, internal controls are ineffective.

(Preliminary summary: Bitcoin users are "kidnapped every week", experts warn: centralized exchange KYC leaks are the main cause)

(Background supplement: kidnapping for ransom, desperate homicide, serial cases, five true records of currency circle cases)

Earlier this week, Theresa Spino, the former chief financial officer (CFO) of Moxie Software, an Illinois software company, was found guilty of four counts of wire fraud for transferring at least one person without authorization. US$35 million of customer custody funds were transferred to a crypto wallet under his control, and all was invested in the decentralized finance (DeFi) protocol before losing all money.

The executive will be sentenced in February next year and faces up to 20 years in prison.

The high-yield myth is shattered

At first, Spino transferred $2.5 million, lied to the company that it would buy back shares, and invested in various high-yield decentralized finance (DeFi) lending protocols. After experiencing a short-term profit, he continued to increase the transfer amount.

But then the cryptocurrency winter came. In early May 2022, the algorithmic stablecoin Terra collapsed, and his $35 million cryptocurrency investment plummeted and finally became almost worthless... Then his evil deeds were exposed and he was prosecuted.

Corporate defenses still need to be strengthened

The Theresa Spino case revealed the vulnerability of companies in the face of the temptation of crypto-finance. The former CFO invested trust funds in high-risk DeFi protocols, ultimately losing all his money and damaging the company’s credibility. This highlights the lack of supervision and risk control mechanisms for digital assets in traditional enterprises. When financial authority is overly concentrated and internal controls are ineffective, trust becomes the biggest loophole.

The deeper lesson is this: technology cannot replace trust. Whether it is AI, blockchain or decentralized finance, if there is a lack of transparency, responsibility and discipline, no matter how advanced the system is, it will become an accelerator of the breakdown of trust.